|

© Six Flags

|

I had to really let this one sink in for a while before covering it here - but as I'm sure you've all heard by now Cedar Fair and Six Flags have

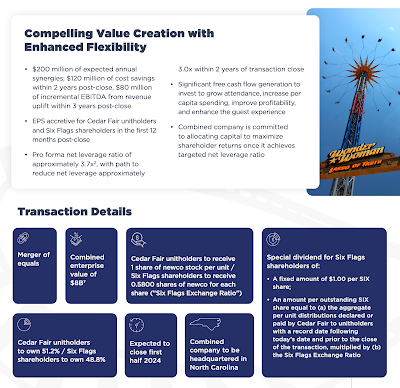

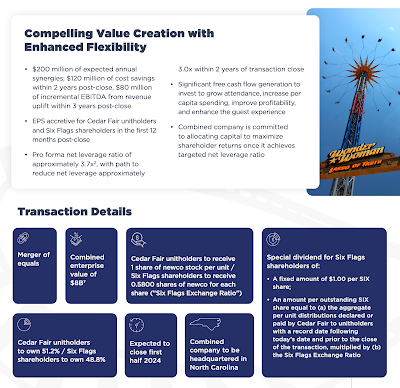

reached an agreement to merge into one company. The new company will trade on the stock market under the ticker FUN but will be called Six Flags Entertainment Corporation. Essentially that means that the company we all love named Cedar Fair will cease to exist when the deal closes in the first half of 2024.

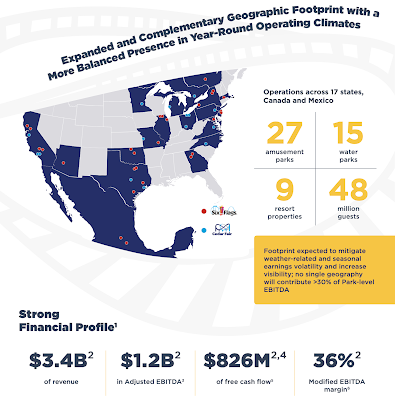

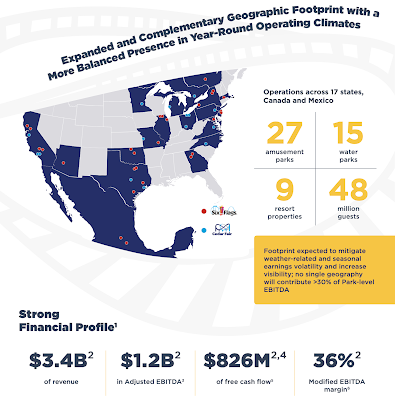

Technically neither company is buying the other in the merger, and shareholders of each company will receive shares of the new Six Flags according to set multipliers announced already. The new company will have an enterprise value of around $8 billion and they will own and operate "27 amusement parks, 15 water parks and 9 resort properties across 17 states in the U.S., Canada, and Mexico." A big plus for the merger is that the company will be less exposed to bad weather in one specific part of the country as they'll have parks much more spread out.

|

© Six Flags

|

The new Six Flags also expects to quickly achieve around $200 million in "annual synergies" - meaning cost savings to the bottom line. From purchasing power to being able to remove duplicate jobs, the new company can push more toward profits by leveraging their larger enterprise. They think they can turn that into as much as $80 million in EBITDA within three years.

|

© Six Flags

|

The new company will have a 12 person board with six members coming from each company. The current Cedar Fair CEO, Richard Zimmerman, will service as the new Six Flags' CEO. Six Flags current CEO, Selim Bassout will become the Executive Chairman of the Board of Directors. Cedar Fair's CFO will keep the position in the new Six Flags and current Six Flags' CFO will become the Chief Integration Officer. The new company's headquarters will stay in North Carolina where Cedar Fair's currently is.

Based of where both companies are currently, the new Six Flags will have around $3.4 billion in revenue, $1.2 billion in EBIDTA and entertain around 48 million people per year. In the end Cedar Fair unit (stock) holders will own 51% of the new company and Six Flags stock holders 49%.

|

© Six Flags

|

On a call regarding the merger leaders of both companies were quick to point out that the plan will allow for a larger amount of free cash flow that they can use to pay down debt. They also say that the larger cash flow will be used for investing in the parks. Exactly how that will work, at least to me, will depend on their performance as paying down debt to support the new company's stock price will typically come first. Since the new company will still be publicly traded the burden of making decisions to support the stockholders will always be #1 - not what the coolest coaster is to build.

|

© Six Flags

|

To me the leadership set up is telling (along with other facts sprinkled so far in this story). I know this is a merger of the companies but to me personally it feels like Cedar Fair is adding Six Flags to their company. From the CEO placement to headquarter location, Cedar Fair seems to be running things here. And from a purely personal opinion that makes sense as Six Flags' leadership feels underwhelming when compared to Cedar Fair's. There are definitely pluses from both companies to explore but Cedar Fair even notes that they think they can vastly improve Six Flags' parks in-park spending, mostly through food and beverage.

However no one can ignore that Six Flags is a clear national brand, perhaps a bit global even, and Cedar Fair is not at all, their parks names' are their real brand. This will also gives all Cedar Fair parks access to Looney Tunes and D.C. Comics, which when done right could be cool, but if smothered into the parks like Six Flags does it could be pretty not cool. Cedar Fair in the past few years entered a new 'make it themed' era and I pray it doesn't stop with this merger.

|

© Six Flags

|

When the deal was announced there was a lot of fear about park areas between the two companies that overlap, and rightfully so. Northern and Southern California, Virginia, Pennsylvania and New Jersey for example. Six Flags and Cedar Fair leaders were asked about this and they do not seem to view these as redundancies, instead they see an opportunity to grow season passes that would allow visitors to go to both parks with one pass - creating an even bigger base of visits, and in turn money.

|

© Six Flags

|

But, when pushed again about the value of divesting "lower return lower quality" parks Cedar Fair's CEO said "As we look at the portfolio, I said this before, there were these are really irreplaceable assets. We’ve always struggled with, how do you grow if you shrink your portfolio. But I do think as we look at the combined portfolio, we’re going to evaluate a whole range of ways to unlock and maximize the

values. I’m most excited about focusing on all 42 to see how we optimize and, and create the ability to generate as much revenue uplift and cash flow generation as possible.

But over time, as stewards of capital in the market, I think our Board will have the opportunity to evaluate what really drives and maximize shareholder returns once we get to that targeted leverage ratio, and we’re looking forward."

So, the new company will most certainly not be afraid of selling (or I shudder to think of other options) parks that are not meeting their standards or present other opportunities that are too good to pass up. Recall that Cedar Fair sold the land under California's Great America well before this merger, knowing full well it meant the eventual end of the park. The comment does acknowledge that these are "irreplaceable assets" but at the same time makes it clear that their job is to "maximize shareholder returns." So while they do not appear to have an immediate plan to divest any parks, it is by no means off the table.

|

© NewsPlusNotes

|

In order for the deal to happen there are several items that have to take place. Largest is an affirming majority vote from the Six Flags Entertainment stockholders. The new company also needs antitrust approval, though that doesn't seem a real issue at all in their minds. Also, the deal can be killed for a number of reasons including if Six Flags board of directors changes its recommendation that stockholders approve the deal or doesn't make the recommendation at all, then a "Cedar Fair Triggering Event" takes place and then Six Flags owes Cedar Fair a cool $63.2 million. The deal itself is about 140 pages long, and I personally can't get through it, but you can

at this link if you like.

The fact that if the deal falls through Six Flags owes Cedar Fair that much money is also telling to me about who holds the power in the deal. That gives me some comfort, but as we've seen in countless other large mergers in other industries, there's always some good and often plenty of bad. Buckle up for this one, indeed.