|

© Six Flags

|

Better late than never, I wanted to take a look at what came from Six Flags Entertainment's Q4 2021 earnings conference call, which took place after the quarter and full year results

were announced. This was the first call for the latest CEO, Selim Bassoul, which is important as they took some time to explain how they see the company moving forward. So while this took place a few weeks ago, it's definitely still worth visiting. Here we go!

• In Q4 2021 Six Flags had revenues of $317 million, up from $261 million in 2019. Attendance was 5.8 million, down slightly from 2019 mostly due to a reporting calendar change. EBITDA was $95 million, up from $72 million in 2019, and net income was a loss of $2 million compared to a loss of $11 million in 2019. Total guest spending was up to $53 a person compared to $40 in 2019.

• In Q4 2021 the company says attendance was at 98% of 2019 levels on an exactly day to day comparison, and when taking out group business it was at 100%. They also had $9 million of employee termination costs in the quarter, matching up to some large layoffs we read about months ago. Active pass base represented 66% of attendance vs. 71% in 2019 as the company focuses on single day visitors again.

• For all of 2021 total revenues were $1.4 billion, up just $9 million from 2019. EBITDA was $498 million, down from $527 million in 2019, and net income was $130 million, down from $179 million in 2019. Attendance for the year was 27.7 million, down from 32.8 million in 2019. Guest spending for the whole year was $52 per person, up from $42 per person in 2019.

|

© Six Flags

|

• At the end of the year the company's active pass base was 8.3 million - 2.1 million members and 6.2 million season pass holders. In 2019 at year end there were 2.6 million members and 5.1 million season pass holders. You can count on those trending toward season passes in the future as memberships have been stopped being sold.

• Lots about the new CEO Selim Bassoul, who noted he has 7 children and has spent a lot of time at theme parks in the past. He wants to create a "customer-obsessed culture" with leaders who are empowered to think like company owners. He also believes in a decentralized business, where corporate office exists to serve the parks, and parks exist to serve visitors.

• Even more, Mr. Bassoul wants to execute their plans faster, creating a performance oriented culture and ridding "corporate bureaucracy" and not relying on their brand alone. They want to be the "most innovative and customer-obsessed theme park company in the world." They have reduced layers of management from 7 to 3, downsized corporate headquarters and given more autonomy to the parks. The main focus for guest experience is "premiumization" of the experience.

|

© Six Flags

|

• In 2021 Six Flags spent $122 million on capital expenditures. They expect the amount for 2022 to be "slightly" higher than 2021.

• The plan for the future is based on three areas of focus - improving the guest experience, pricing and capital allocation.

• To improve the guest experience they have six initiatives:

1 - ride efficiency will be improved by reducing wait times, ride downtimes and opening rides with the park each day. Single rider lines will also be added and they will experiment with virtual queuing.

2 - create fun through employee friendliness, treating visitors like family.

3 - park cleanliness including better curb appeal, better landscaping and better restrooms.

4 - better quality food. They hired a new executive chef and the CEO has tasted hundreds of burgers, pizza and chicken tenders. They will also add healthy options and more beverages like coffee and alcohol. F&B was 21% of their revenue last year and they want it higher.

5 - adding more guest amenities like more benches, more shaded areas and parent lounges.

6 - improve guest facing technology, mainly the Six Flags app.

It seems like these items are basic no-brainers that have been touted by previous management time and time again, so let's hope they stick with the plan this time and make improvements as listed above.

|

© Six Flags

|

• To improve the company's pricing they will rely on the fact that they have done surveys that show guests will pay more for a better experience. The CEO said the company has long ignored that and packed the parks full of guests with cheap tickets and passes. They will focus on attracting guests who will pay more for a less crowded park that is easier to navigate with shorter lines and less pressure on park operations. They've also removed memberships and changed the season pass system to three levels that have higher price points and more opportunities for upselling.

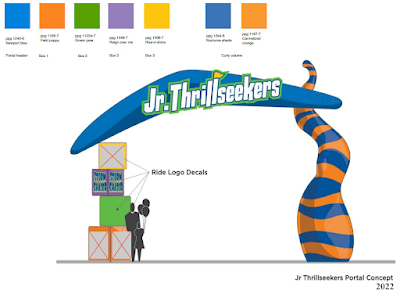

• Changing capital allocation is the last area of focus, and they will be focused on reinvesting in the business, but not only on thrill rides. In the past they spent about 60% of capital funds on rides which added capacity and were marketable but short lived on bringing guests. Now they have a ton of rides and will still add them, less frequently, but focus more on spending on guest-facing technology, food and beverage and park infrastructure improvements. The 2nd focus is to use cash for paying down debt. For spending on the parks they used to look at it as a percent of revenues, and now they think more of a static amount to spend each year, though that amount was not disclosed. They note that what they will focus on (technology, F&B, infrastructure) costs much less than thrill rides. So, more bang for their buck. Finally, they do plan to try to attract families to the parks again, by working on children's areas, kids meals, etc.

• When asked if mergers and acquisitions were part of the new plan the CEO said that they're only focused on creating a better experience and paying down debt, and that mergers and acquisitions are not a part of the "foreseeable future." Also, it does not seem that they have any plan to start to pay shareholders a dividend again any time soon.